Online payments go much further than just in web shops

Online payments go much further than just in web shops, we provide the implementation in your process.

When we think of online payments, webshops are often the first thing that comes to mind. Payment platforms like Stripe, Mollie, and others have revolutionized e-commerce, enabling businesses to accept digital payments seamlessly. But the scope of online payments goes far beyond online retail.

Where online payments also shine

Subscription-based services

From Netflix, Spotify, digital newspaper to fitness subscriptions (always popular in January 😁), more and more services are offered through subscriptions. This is interesting for both the customer and the supplier.

The customer has the freedom to stop and start a service whenever he/she wants, which improves the customer experience.

The supplier receives payments in a timely manner and can, for example, use smart payment retries, automate the creation and sending of invoice documents and could offer payment in multiple currencies.

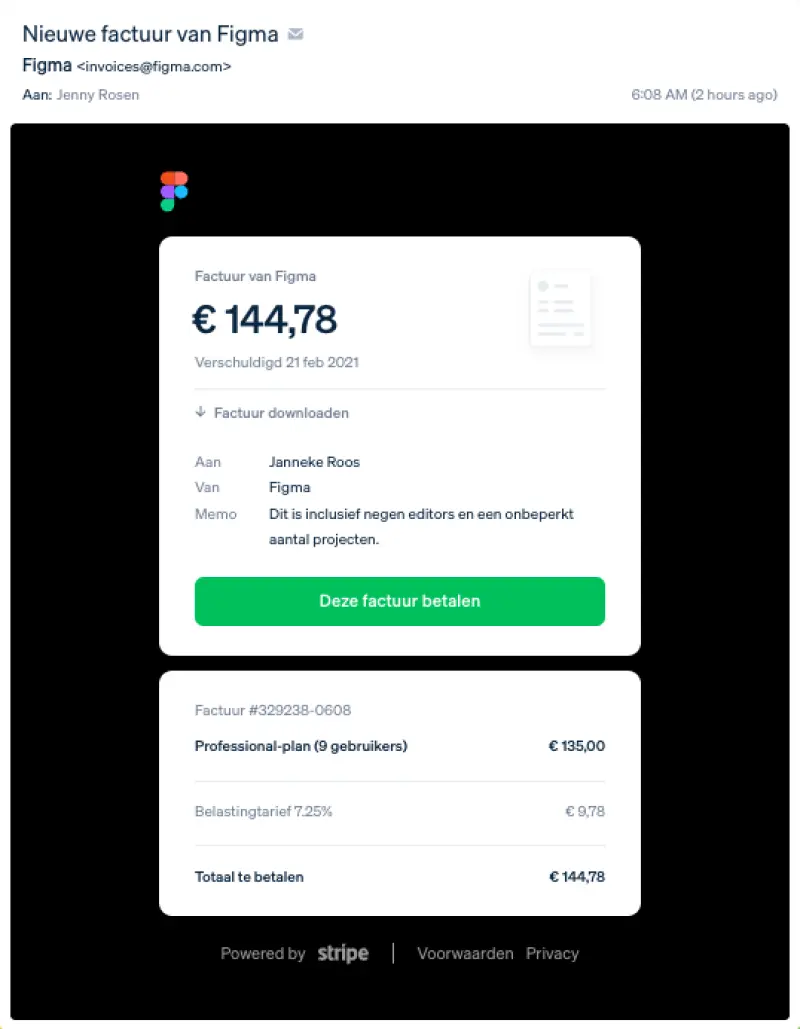

Payment of professional services

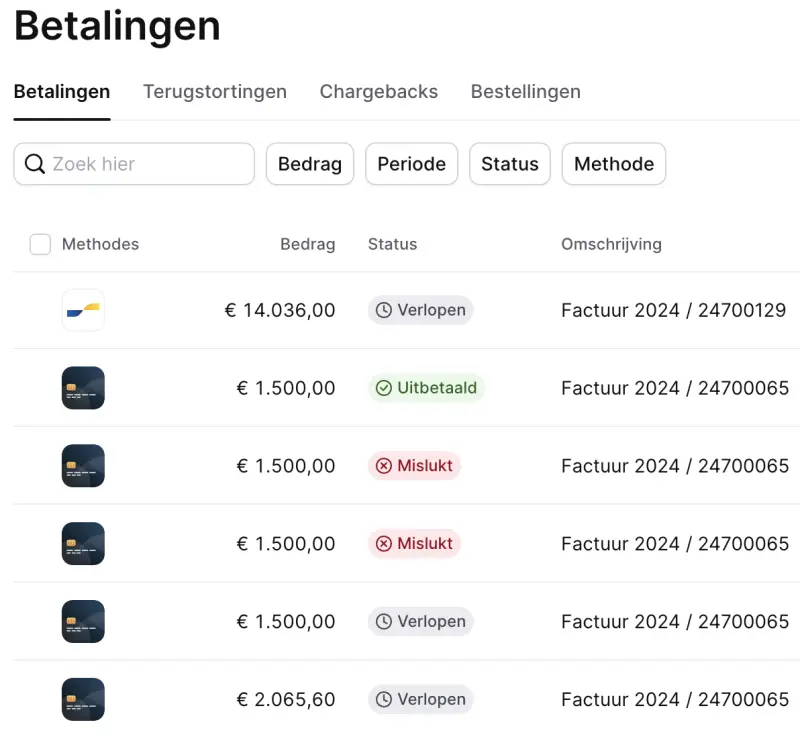

Traditionally, a company creates an invoice and has it paid by bank transfer within a payment term of 30 days. More and more companies use online payments to streamline invoicing and ensure timely payments. This automation reduces administrative work, brings in the money faster and improves cash flow.

Moreover, online payments are not limited in amount, such as a Payconiq link or QR code that you enter with your banking app, you can also pay larger amounts (> €1000) online.

Pay for a sports activity or rent equipment

Anyone who actively practices sports such as padel will have noticed that reserving a padel court or sometimes renting a padel racket is done via online payment. An example of a global court reservation system with online payment is the popular Playtomic, but the Tennispadel Flanders federation also has a similar platform.

Extra benefits with online payments

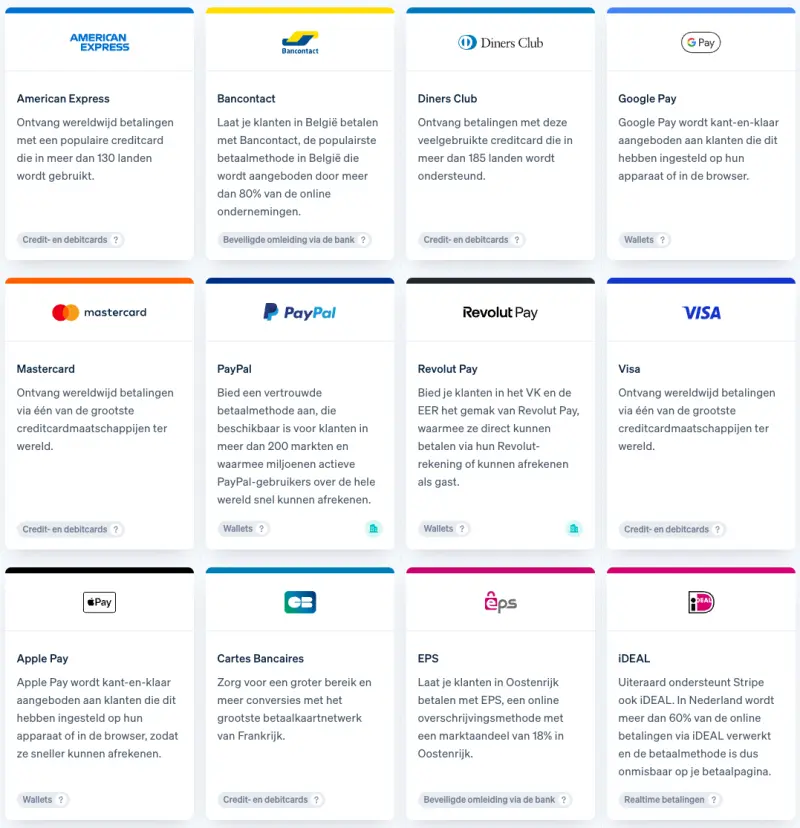

Wider range of payment methods

A customer suddenly has a wide range of payment methods, such as credit cards, digital wallets, and also old-school bank transfers. This ensures that customers can pay in the way that’s most convenient for them. This also reduces friction and increases the chance of receiving a payment quickly. The payment platform Stripe indicates that 87% of all invoices are paid within 24 hours.

Streamlined operations, save time in administration

Platforms that arrange online payments offer much more than just payment, some examples:

automatically generate and send an invoice document (mobile friendly, multilingual)

automatically send email reminders for unpaid invoices

Retry failed payment attempt at the most appropriate time

create credit notes with automatic reimbursement

applying the correct tax rules, based on what and where you sell

integration with accounting software

reporting

This frees up time for the entrepreneur for more meaningful core tasks.

Enhanced Security

Reputable platforms like Stripe and Mollie comply with stringent security standards, such as PCI DSS, to protect sensitive payment data. This instills confidence in customers and reduces the risk of data breaches.

Worldwide payments without delay

Digital payment systems support multiple currencies and payment methods, enabling businesses to reach customers across borders. Traditional manual bank transfers are more complicated and slower to transfer money, digital payments are processed almost instantly.

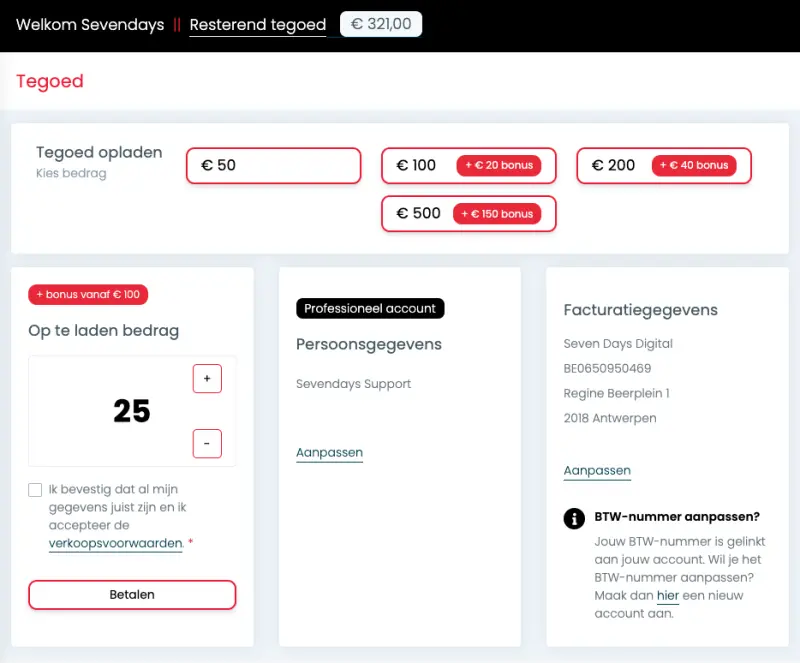

Digital wallet

Many platforms also offer a digital wallet, which has a benefit for both the company and the customers.

A customer can purchase a budget of credits, whereby the purchase of more credits automatically results in a certain percentage of free extra credits.

The advantage for the company is that you get your money in advance from your customer and you don't have to waste time chasing bad or late payers.

You often see this concept at sports clubs (court reservations at Tennispadel Vlaanderen and Playtomic) but also at the more modern car wash.

Which online payment platform is the best: Mollie or Stripe?

Mollie and Stripe are two leading online payment platforms, but they have distinct differences in terms of features, target audience, and usability. Here's a comparison:

Ease of use

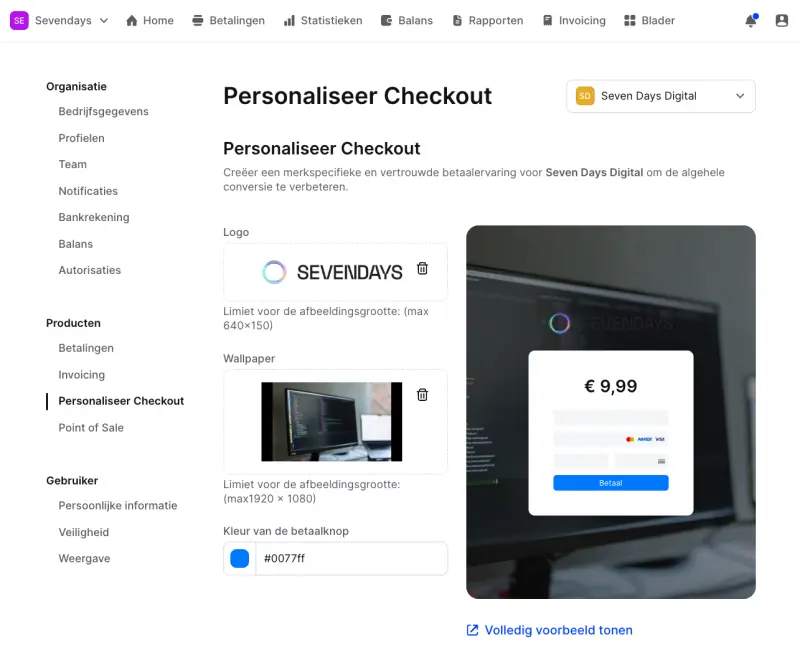

Mollie: Known for its simplicity and user-friendly interface. It's designed for businesses that want to get started quickly and don't need complex implementation.

=> Mollie is used by AVA, Torfs, Teamleader, Club Brugge, Get Driven, Standaard Boekhandel, Q-Park, Ballet van Vlaanderen, Veloretti,…Stripe: is highly customizable, making it best suited for businesses looking to build custom payment solutions.

Supported Payment Methods and Regional Availability

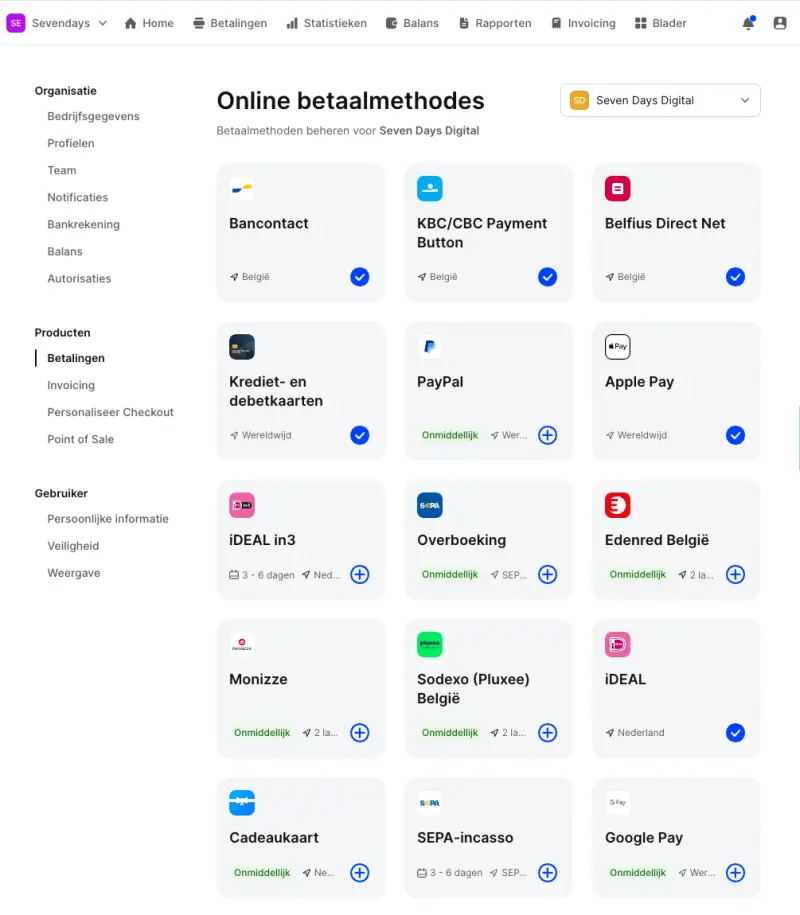

Mollie: Strongly focuses on European, local payment methods. In addition to the well-known international payment options such as credit cards, Apple Pay, PayPal, etc., in Belgium you also have integration with local banking apps such as KBC and Belfius, as well as support for Eco and meal vouchers from Edenred or Sodexo (Pluxee).

Stripe: Provides support for a broader range of global payment methods (in over 135 countries), including major credit cards, Apple Pay, Google Pay, and more. Stripe also supports some regional methods, but its strength lies in its global reach.

Both Mollie and Stripe are excellent payment platforms, but the choice depends on the specific needs, location of your customers and activities and technical needs of your application.

Summary

Online payment systems are no longer just tools for e-commerce, they are essential for many services in our daily lives. By implementing platforms like Stripe and Mollie, companies can leverage greater efficiencies, improved customer satisfaction, and the ability to scale globally.

Whether you run a non-profit organization, organize events, operate a sports club or offer professional services, using digital payments has become almost indispensable in today's digital-first economy.

We take care of the implementation of online payments in your process!